43 zero coupon bond accrued interest

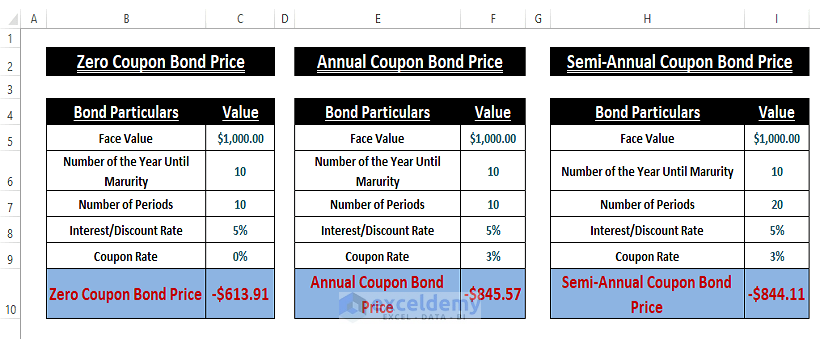

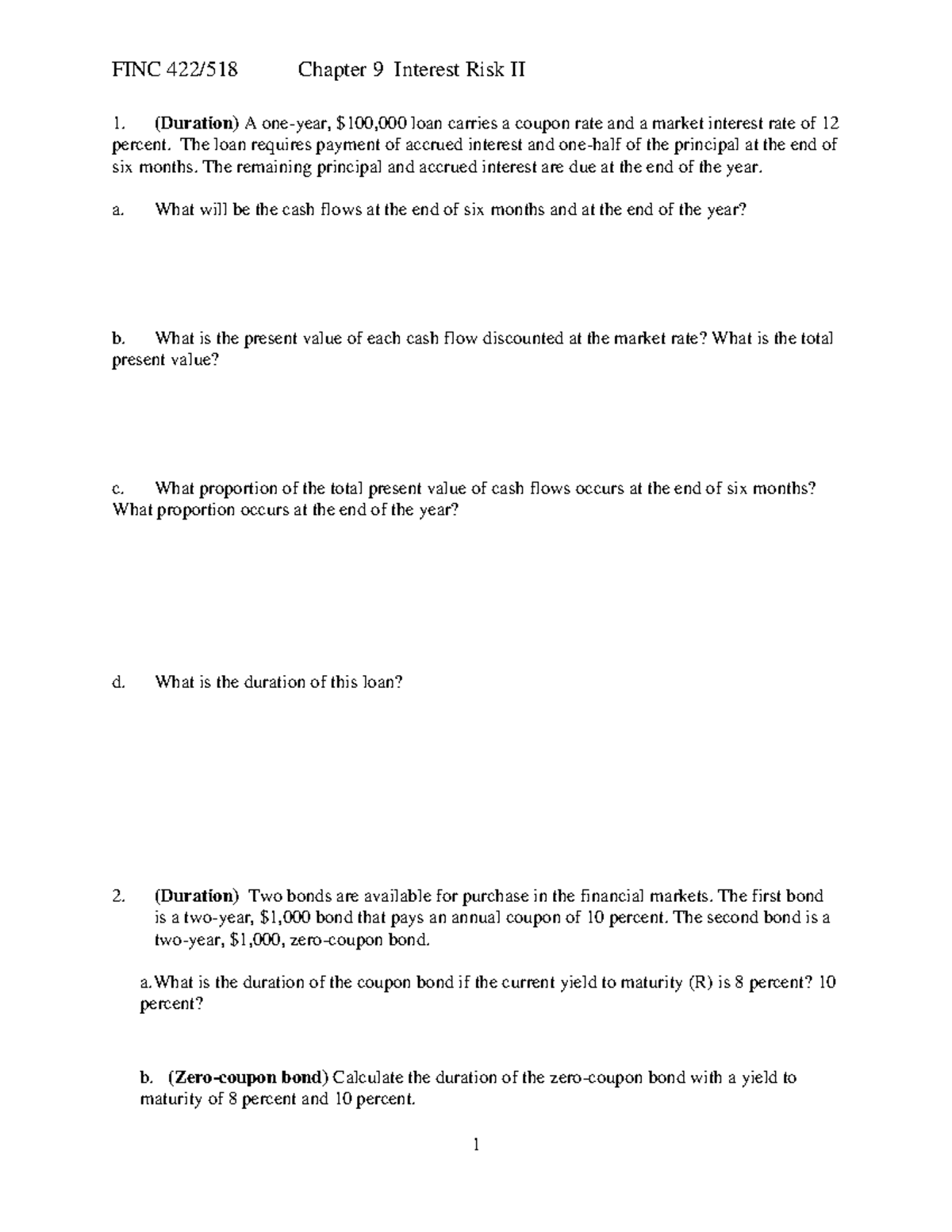

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

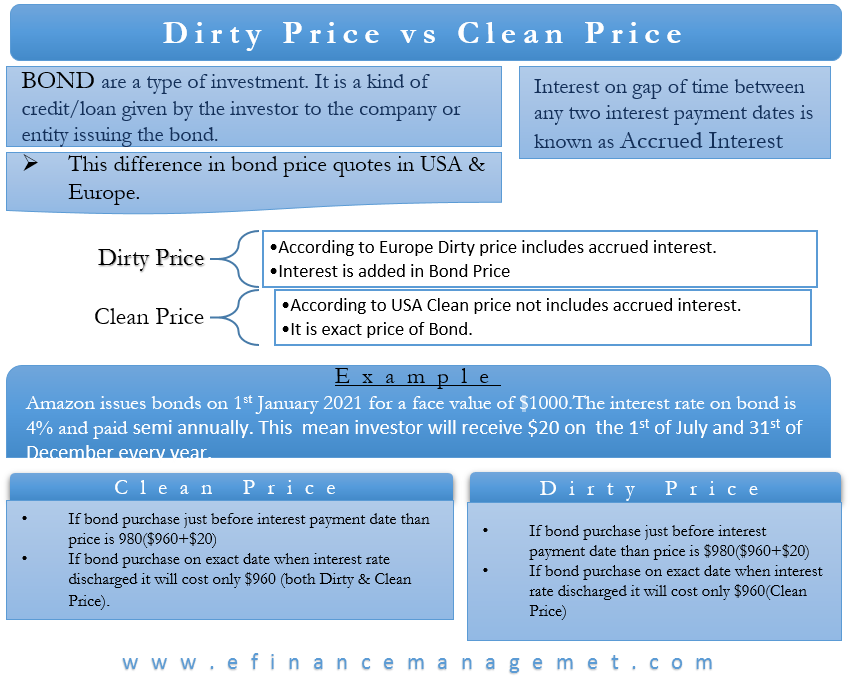

How to Calculate PV of a Different Bond Type With Excel - Investopedia Feb 20, 2022 · Since the last coupon was issued, there have been 119 days of accrued interest. Thus the accrued interest = 5 x (119 ÷ (365 ÷ 2) ) = 3.2603. The Bottom Line

Zero coupon bond accrued interest

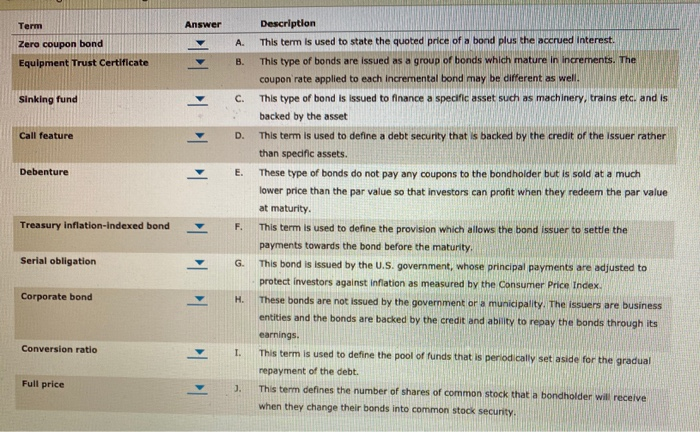

Instructions for Forms 1099-INT and 1099-OID (01/2022) Include in box 8 any accrued qualified stated interest on these bonds sold between interest dates (or on a payment date). For a tax-exempt covered security acquired at a premium, see Box 13. Bond Premium on Tax-Exempt Bond, later. Any exempt-interest dividends from a mutual fund or other RIC are reported on Form 1099-DIV. Zero-Coupon Bonds: Characteristics and Calculation - Wall … A Zero-Coupon Bond is priced at a discount to the face (par) value with no periodic interest payments from the issuance date until maturity. ... Accrued Interest; Bond Quotes. A bond quote is the current price at which a bond is trading, expressed as a percentage of the par value. Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years’ maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

Zero coupon bond accrued interest. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... The coupon bond method, described in the following discussion, applies if the debt instrument is issued at par (as determined under Regulations section 1.1275-7(d)(2)(i)), all stated interest payable on the debt instrument is qualified stated interest, and the coupons have not been stripped from the debt instrument. This method applies to TIPS ... Bond Price Calculator – Present Value of Future Cashflows Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Bond Discount Amortization | Journal Entries & Example Oct 31, 2020 · Where BD is the total bond discount, n is the bond life in year and m is the total coupon periods per year. Effective interest method. Under the effective interest method, bond discount amortization each period equals the difference between the product of bond carrying value and market interest rate and the product of bond face value and the ... Rising bond yields: what happens to bonds when interest rates rise Oct 11, 2022 · That fixed rate of bond interest is formally called a coupon rate. For example, a bond with a 4% coupon pays £4 per year on its principal of £100.2. The £100 principal is the amount loaned to the government in the first place, when the bond is issued. When the bond matures, whoever owns it at that point will get that £100 back.

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years’ maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Zero-Coupon Bonds: Characteristics and Calculation - Wall … A Zero-Coupon Bond is priced at a discount to the face (par) value with no periodic interest payments from the issuance date until maturity. ... Accrued Interest; Bond Quotes. A bond quote is the current price at which a bond is trading, expressed as a percentage of the par value. Instructions for Forms 1099-INT and 1099-OID (01/2022) Include in box 8 any accrued qualified stated interest on these bonds sold between interest dates (or on a payment date). For a tax-exempt covered security acquired at a premium, see Box 13. Bond Premium on Tax-Exempt Bond, later. Any exempt-interest dividends from a mutual fund or other RIC are reported on Form 1099-DIV.

Post a Comment for "43 zero coupon bond accrued interest"