43 coupon rate semi annual

What Is the Coupon Rate of a Bond? - The Balance When the government or a company issues a bond, the rate is fixed. The coupon rate is stated as an annual percentage rate based on the bond's par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a semiannual basis—to the bondholder until the bond is redeemed at maturity. How Coupon Rates Work Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually.

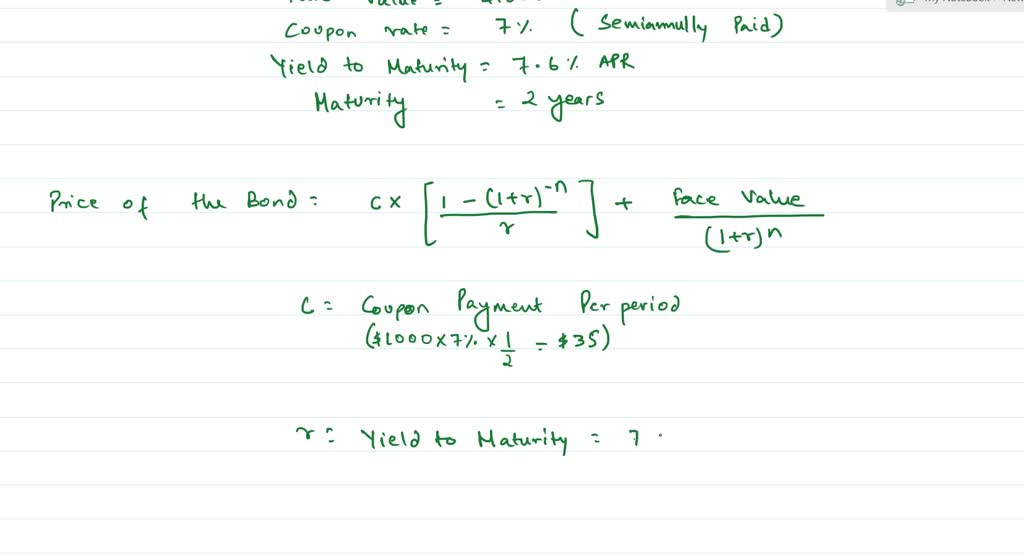

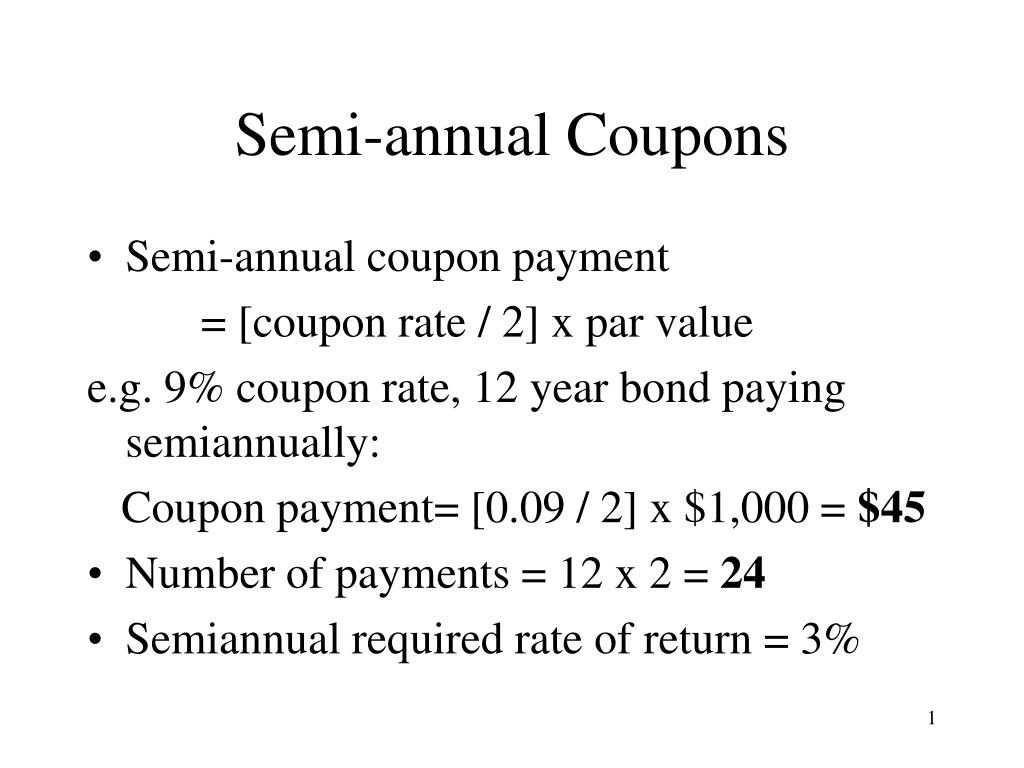

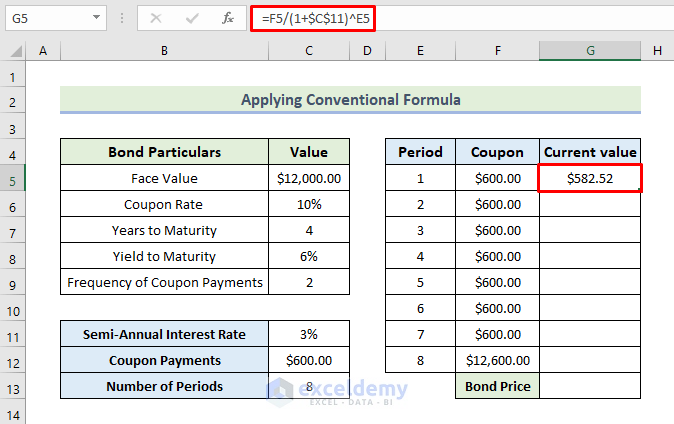

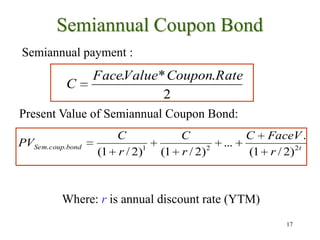

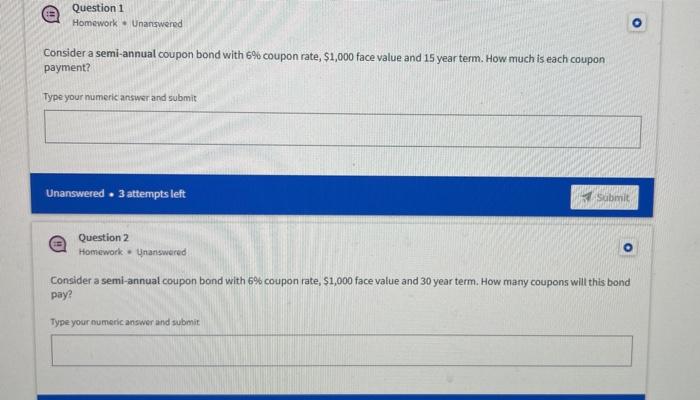

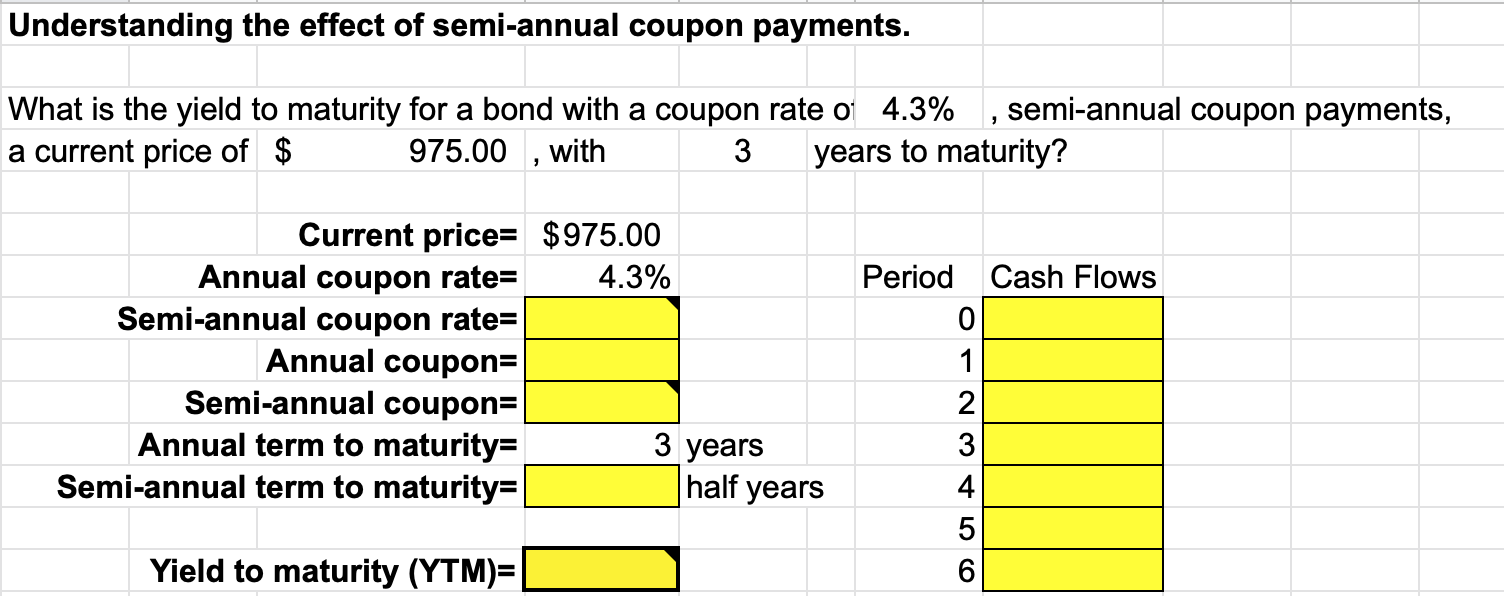

How to Calculate Semi-Annual Bond Yield | Pocketsense To calculate the semi-annual return rate of your bonds, you can utilize a series of simple calculations. These include dividing the annual coupon rate in half, calculating the total number of compounding periods, and multiplying the bond's current face value by the semiannual interest rate in order to determine the semiannual payment amount.

Coupon rate semi annual

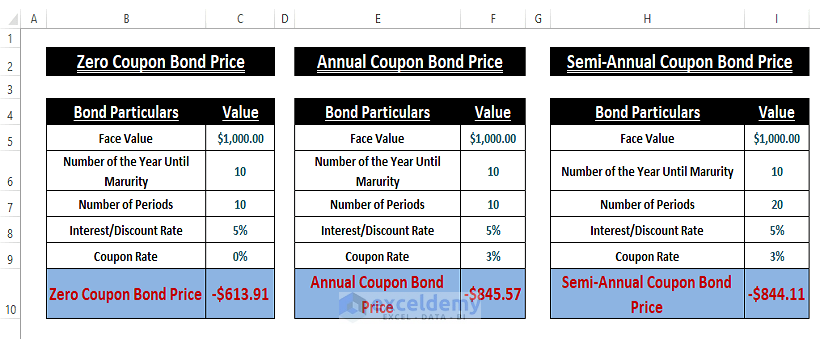

Coupon Rate: Formula and Bond Calculation - Wall Street Prep Coupon Rate (%) = $50,000 / $1,000,000 Coupon Rate (%) = 5% Therefore, the bond is priced at a coupon rate of 5% on a $1 million par value, resulting in two semi-annual payments of $25,000 per year until the bond reaches maturity. Solved The yield to maturity of a $1,000 bond with a | Chegg.com The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Part 1 The price of the bond is $enter your response here. (Round to the nearest cent.) How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays...

Coupon rate semi annual. Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Coupon Payment Calculator If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates. You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 How to convert the effective semi-annual rate to APR - Quora Answer (1 of 4): You're all getting EAR and APR confused. The annual percentage rate (APR) is the annual rate ignoring compounding, and the effective annual rate (EAR) is the annual rate with compounding. So if you have a monthly rate of 1% interest, the APR is 12 x 1% = 12%, while the EAR is (... Bond Price Calculator | Formula | Chart Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50 ...

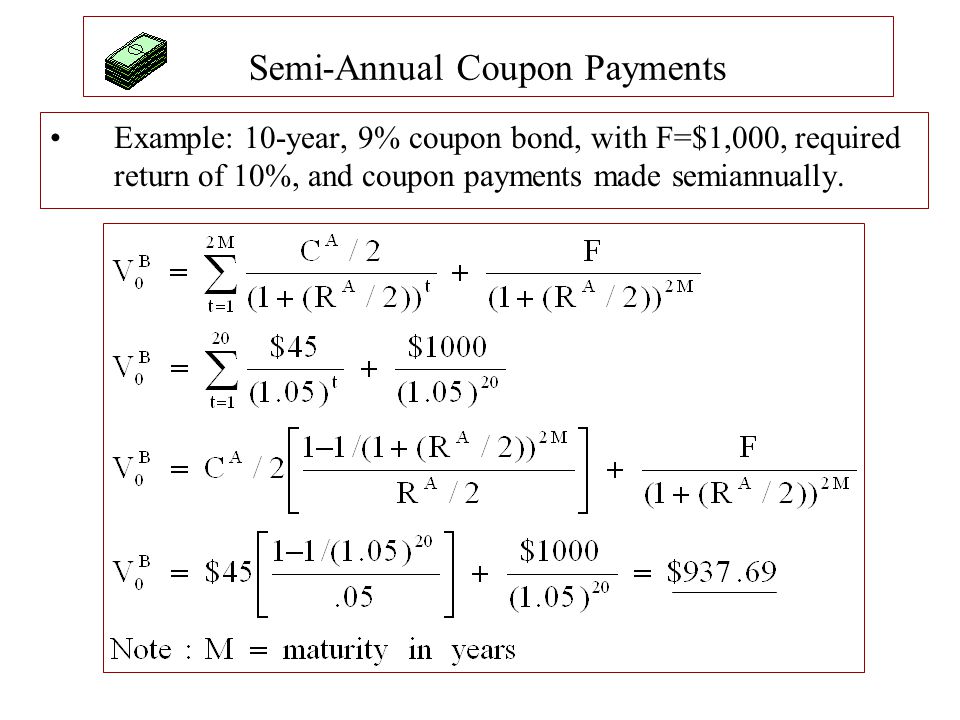

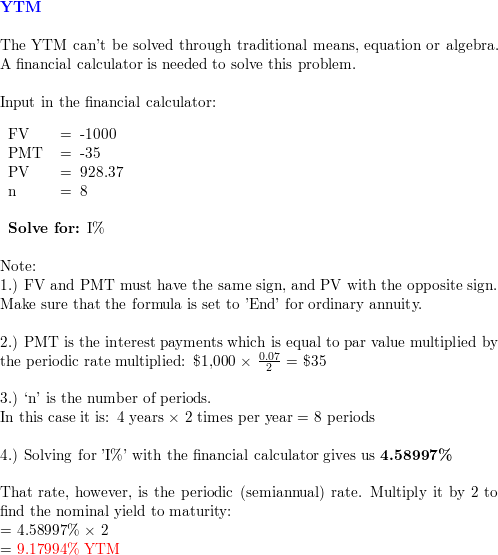

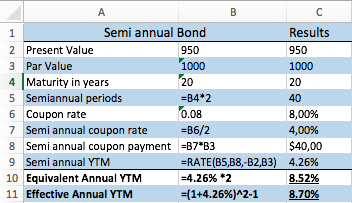

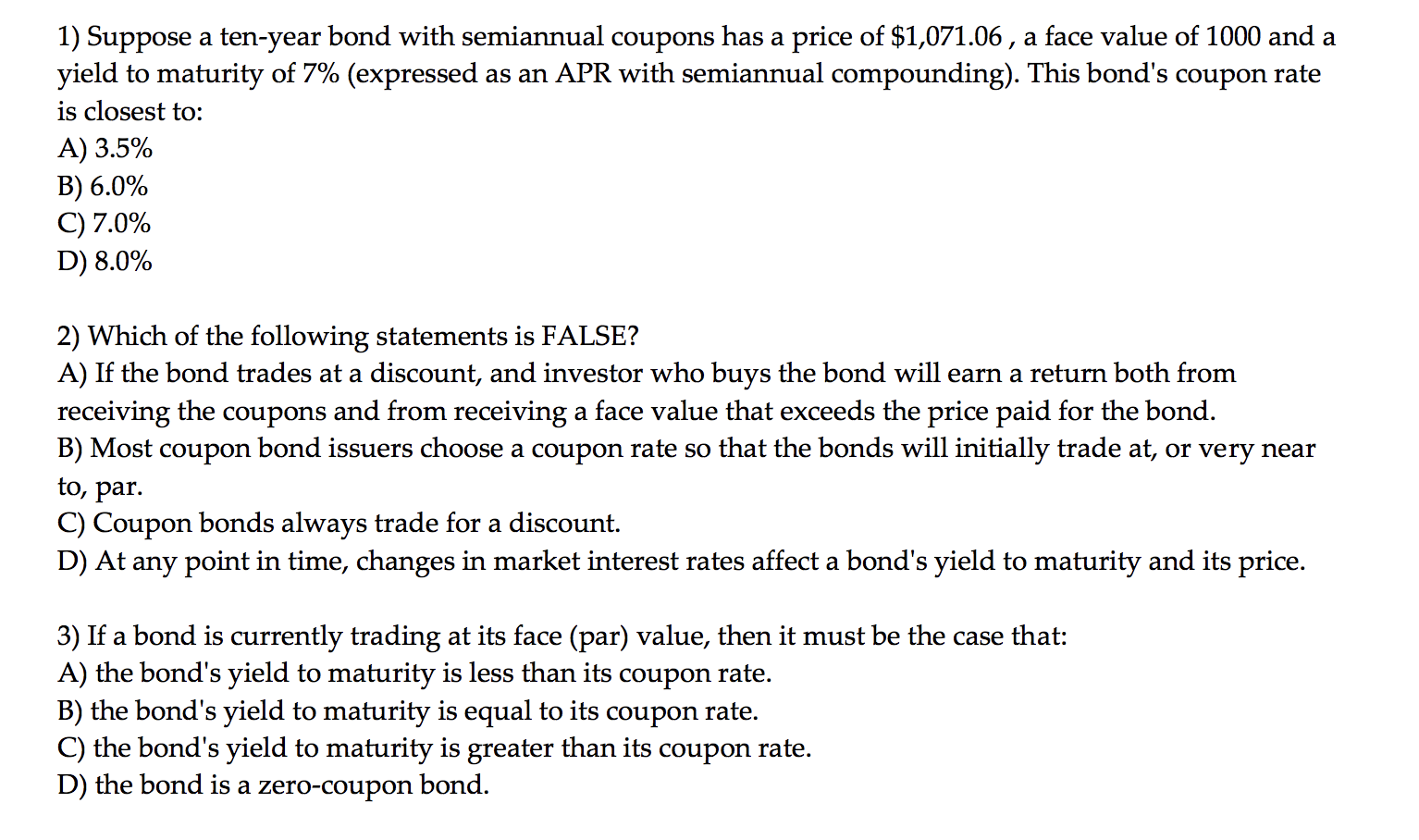

Suppose a ten-year, \ ( \$ 1,000 \) bond with an \ ( | Chegg.com What is the bond's coupon rate? The bond's coupon rate is \%. (Round to three decimal places.) Suppose a seven-year, $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading with a yield to maturity of 6.66%. a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. Calculate The Price Of A Bond With Semi Annual Coupon ... - YouTube The current price of a bond is found by calculating the sum of the present value of its remaining coupons and principal. However, since we're accounting for ... Suppose a 10-year, $1000 bond with an 8% coupon rate and semiannual ... In calculating the yield I used the rate formula in Excel, rate formula is given as: =rate(nper,pmt,-pv,fv) nper is period to maturity of 10 years multiplied by 2(semi-annual compounding) pmt is the coupon interest payable semi-annually which 8%*$1000/2=$40. pv is the current price of $1034.74. fv is the face value of $1000 =rate(20,40,-1034.74 ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

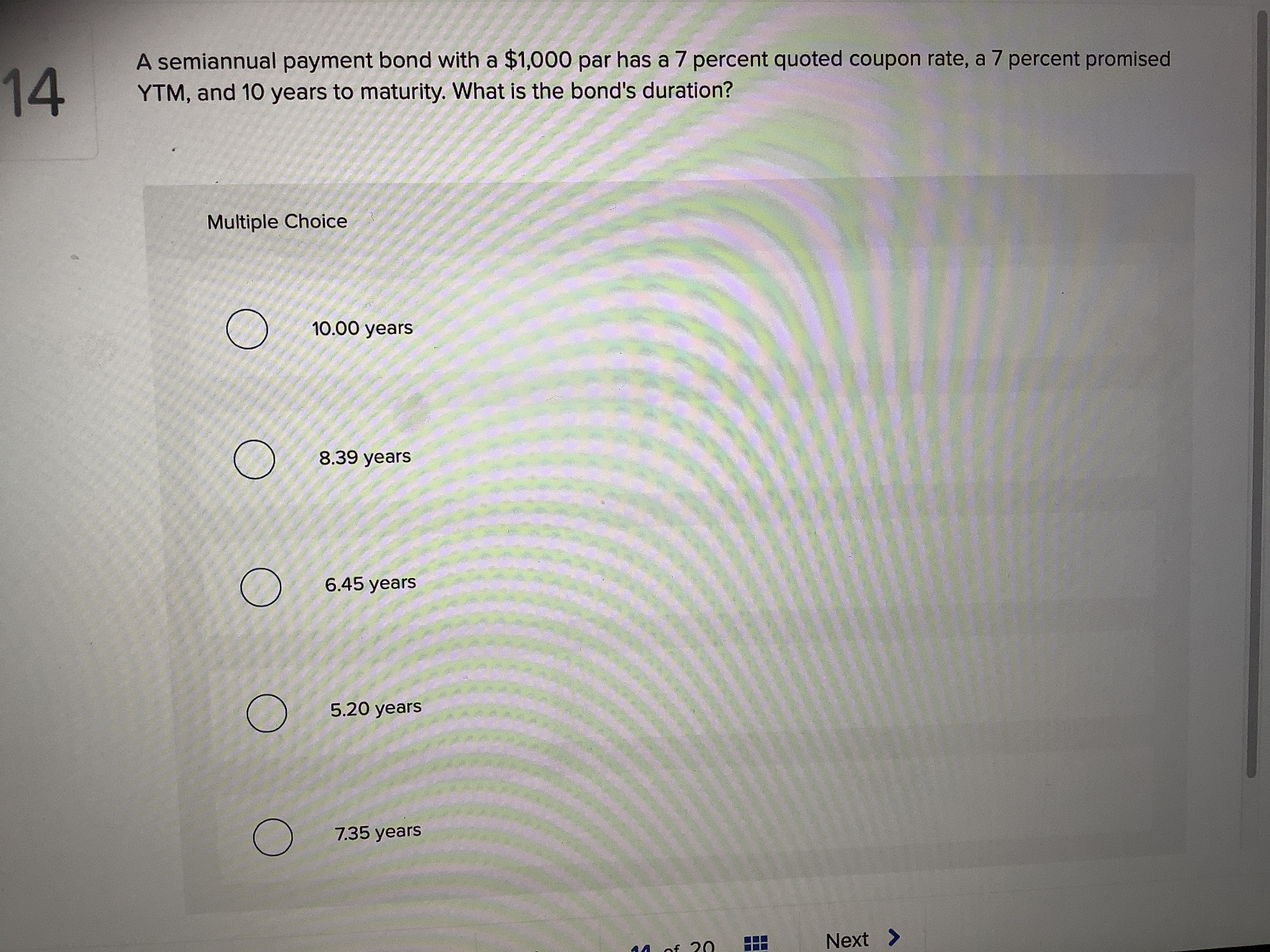

Coupon Rate Definition - Investopedia For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable... 7. Calculate a bond's coupon rate wiht semiannual compounding.docx Calculate a bond's coupon rate with semiannual compounding. Volbeat Corporation has bonds on the market with 10.5 years to maturity, a YTM of 6.2 percent, a par value of $1,000, and a current price of $945. The bonds make semiannual payments. What is the annual coupon rate on the bonds? Here, we need to find the coupon rate of the bond. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct. Coupon Rate Formula & Calculation - Study.com The coupon rate definition refers to the annual coupon payments paid by the issuing business organization relative to the bond;s face value. Usually, bonds offer coupon payments...

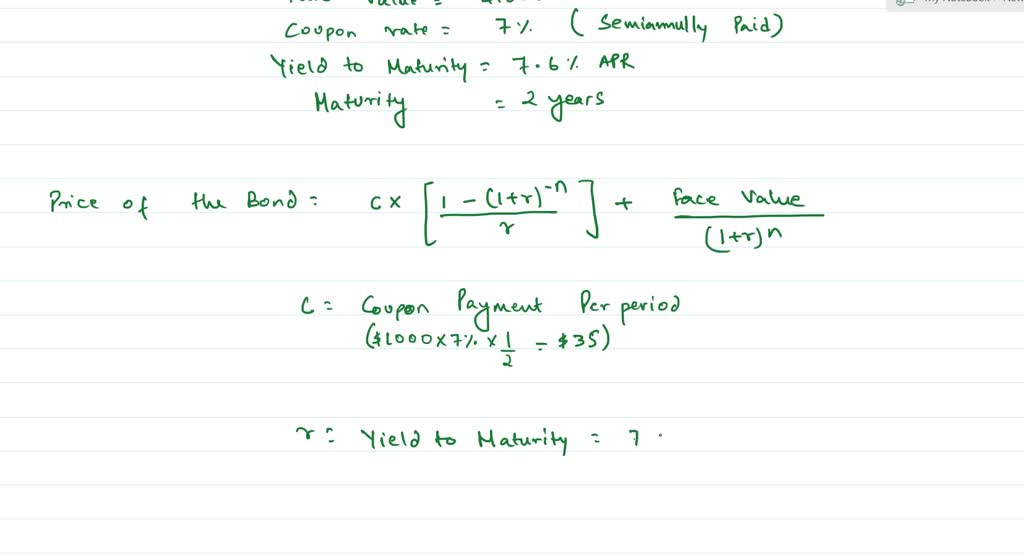

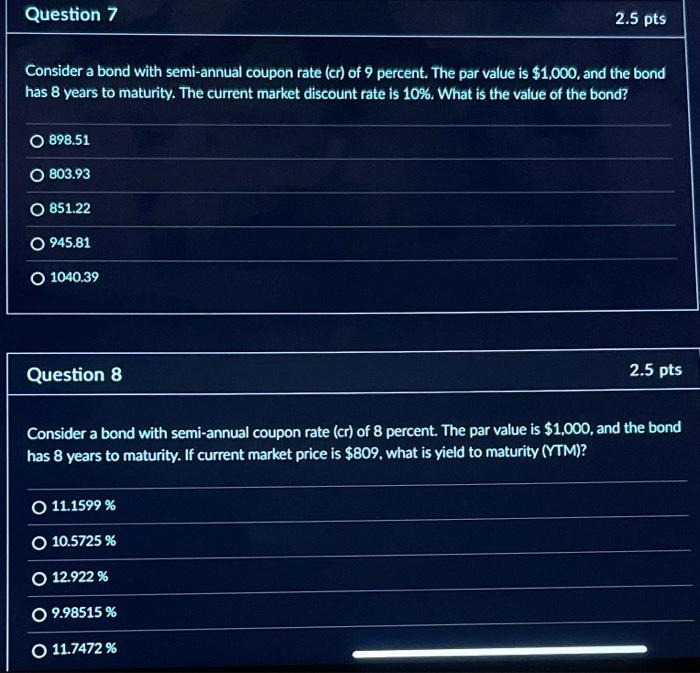

The yield to maturity of a 1 comma 0001,000 bond with a 7.0 %7.0% coupon rate, semiannual coupons, and two years to maturity is 7.6 %7.6% APR, compounded semiannually. What is its price?

Semi-Annual Coupon Rate Definition | Law Insider Related to Semi-Annual Coupon Rate Semi-Annual Period means each of: the period beginning on and including January 1 and ending on and including June 30; and the period beginning on and including July 1 and ending on and including December 31. Coupon Rate has the meaning set forth in Section 2.8.

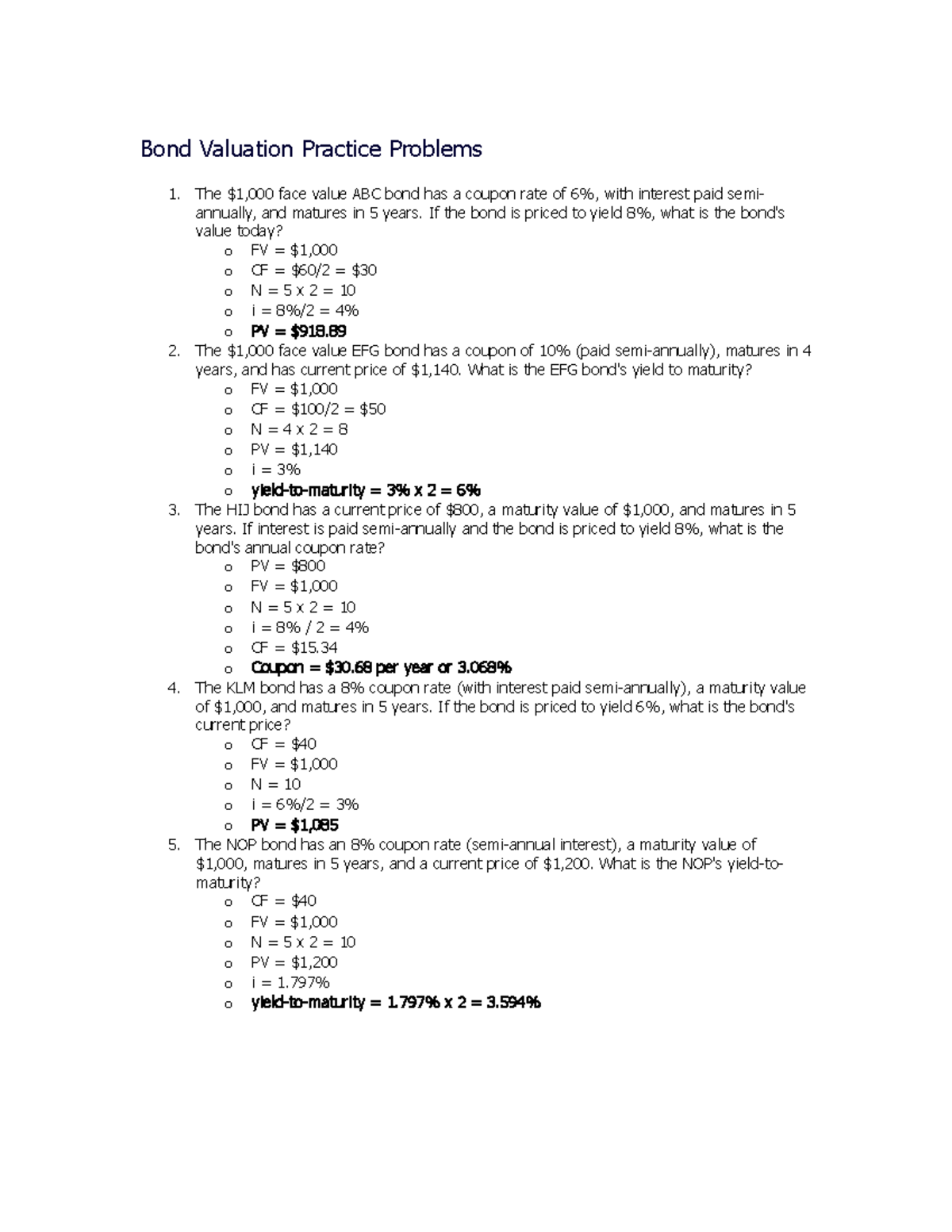

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

Zero Coupon Bond Calculator - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. ... As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia Suppose you purchase an IBM Corp. bond with a $1,000 face value that is issued with semiannual payments of $10 each. To calculate the bond's coupon rate, divide the total annual interest...

Calculate the Value of a Coupon Paying Bond - Finance Train The value of a coupon paying bond is calculated by discounting the future payments (coupon and principal) by an appropriate discount rate. Suppose you have a bond with a $1,000 face value that matures 1 year from today. The coupon rate is 12% and the bond makes semi-annual coupon payments of $60. The bond yield is 13%.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset The term "coupon rate" specifies the rate of payment relative to a bond's par value. Secondly, a bond coupon is often expressed in a dollar amount. For example, a bank might advertise its $1,000 bond with a $50 semiannual coupon.

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period.

How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays...

Solved The yield to maturity of a $1,000 bond with a | Chegg.com The yield to maturity of a $1,000 bond with a 7.1% coupon rate, semiannual coupons, and two years to maturity is 7.9% APR, compounded semiannually. What is its price? Part 1 The price of the bond is $enter your response here. (Round to the nearest cent.)

Coupon Rate: Formula and Bond Calculation - Wall Street Prep Coupon Rate (%) = $50,000 / $1,000,000 Coupon Rate (%) = 5% Therefore, the bond is priced at a coupon rate of 5% on a $1 million par value, resulting in two semi-annual payments of $25,000 per year until the bond reaches maturity.

![ANSWERED] The bond has the current price of $1,123 and par ...](https://media.kunduz.com/media/sug-question/raw/66525805-1657158833.9100924.jpeg)

Post a Comment for "43 coupon rate semi annual"