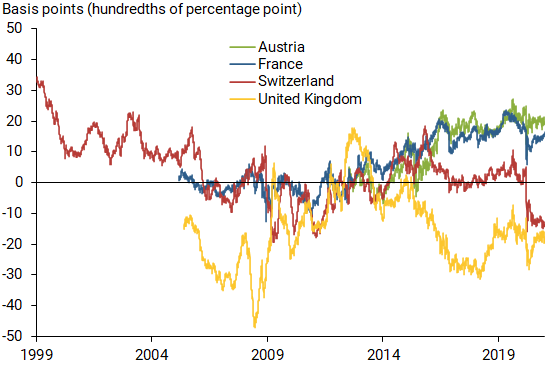

45 coupon rate 10 year treasury

Solved The yield to maturity on a 10-year Treasury note | Chegg.com The yield to maturity on a 10-year Treasury note (with face value = $100 and annual coupon rate = 2.625%) is 3.37%. If the price of this Treasury note goes up, its: I. coupon rate drops below 2.625%. II. coupon rate rises above 2.625%. III. yield to maturity drops below 3.37%. IV. yield to maturity rises above . Question: The yield to maturity ... Interest Rates - U.S. Department of the Treasury Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Corporate Bond Yield Curve. Receipts & Outlays. Monthly Treasury Statement. ... For example, if the 5-year CMT rate was 8.00%, then the annualized effective yield, or APY, would be: APY = (1 + .0800/2) 2-1 APY = 1.081600 -1 APY = 0.081600.

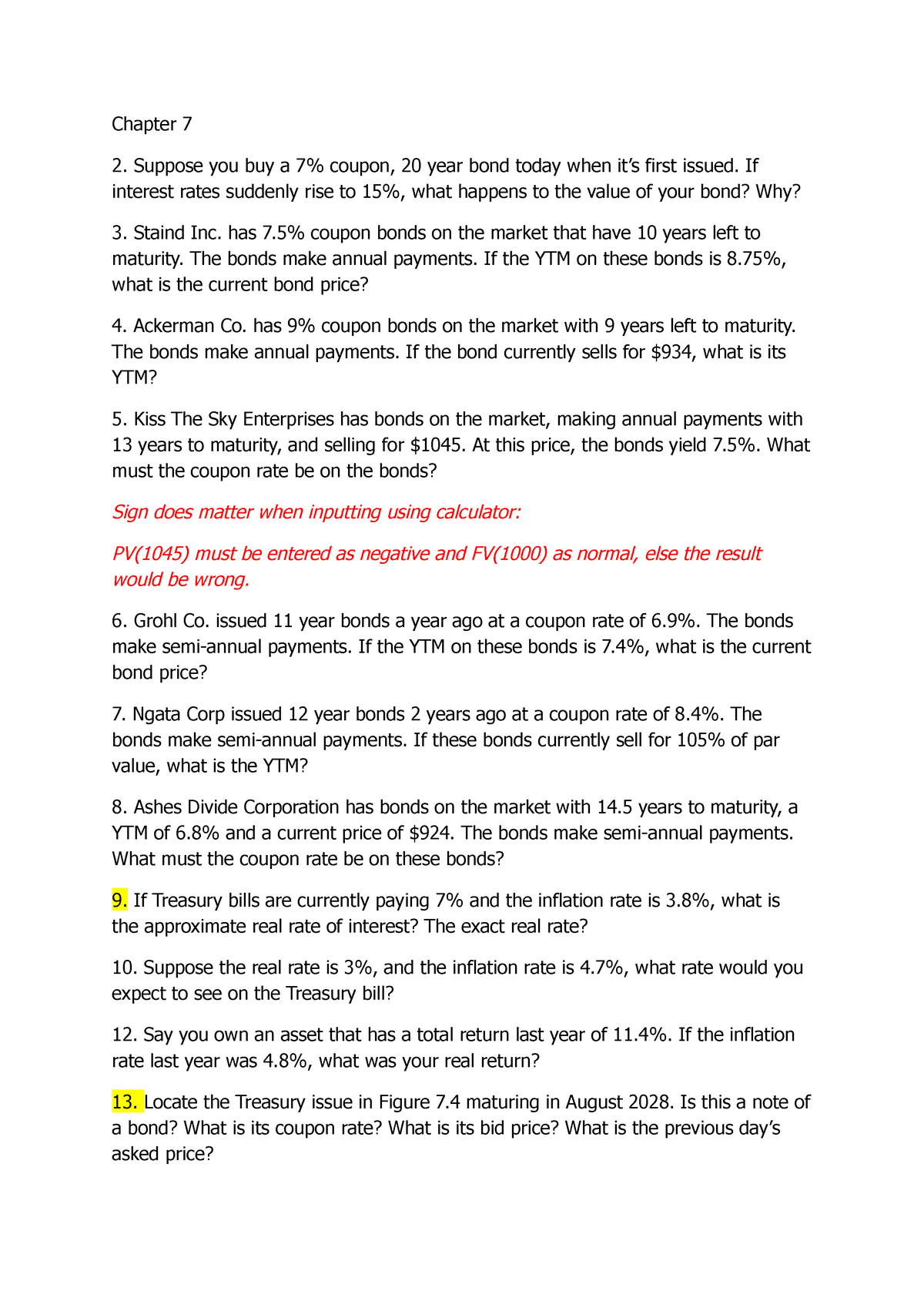

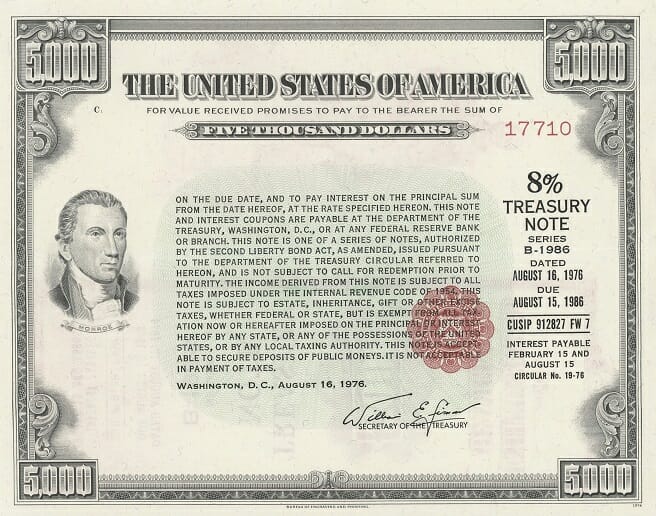

What Is a 10-Year Treasury Note and How Does It Work? The basics of a 10-year T-note involve paying the government a single lump sum at the beginning to purchase the bond — $1,000 apiece. The government then pays interest twice a year until the bond matures, at which point the entire sum you borrowed will be returned. The interest rate, known as the "yield," expresses the annual return on ...

Coupon rate 10 year treasury

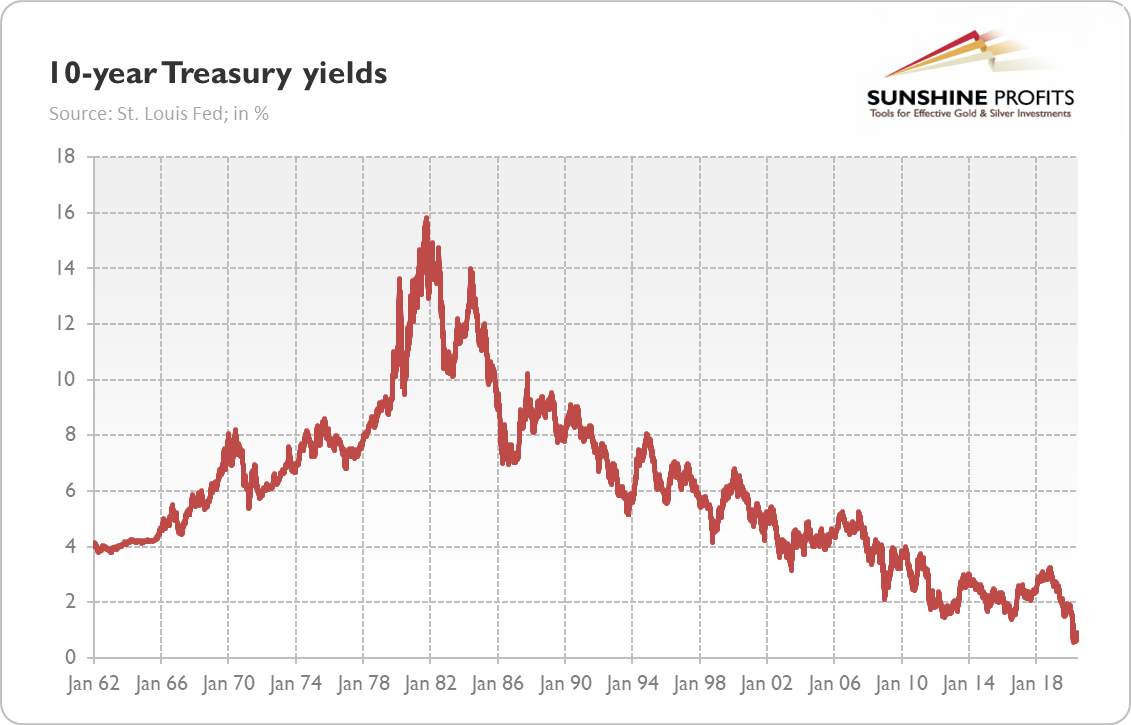

Understanding The 10-Year Treasury Yield - Forbes Advisor The 10-year Treasury yield also impacts the rate at which companies can borrow money. When the 10-year yield is high, companies will face more expensive borrowing costs that may reduce their ... TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview 21.09.2022 · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates. 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 16, 2022 is 3.45%. Show Recessions Download Historical Data Export Image

Coupon rate 10 year treasury. TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ Vor 1 Tag · TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today’s stock price from WSJ. TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Price 91 10/32 Change -25/32 Change Percent -0.85% Coupon Rate 2.750% Maturity Aug 15, 2032 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Premium This 'single greatest... United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an ... Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10 ...

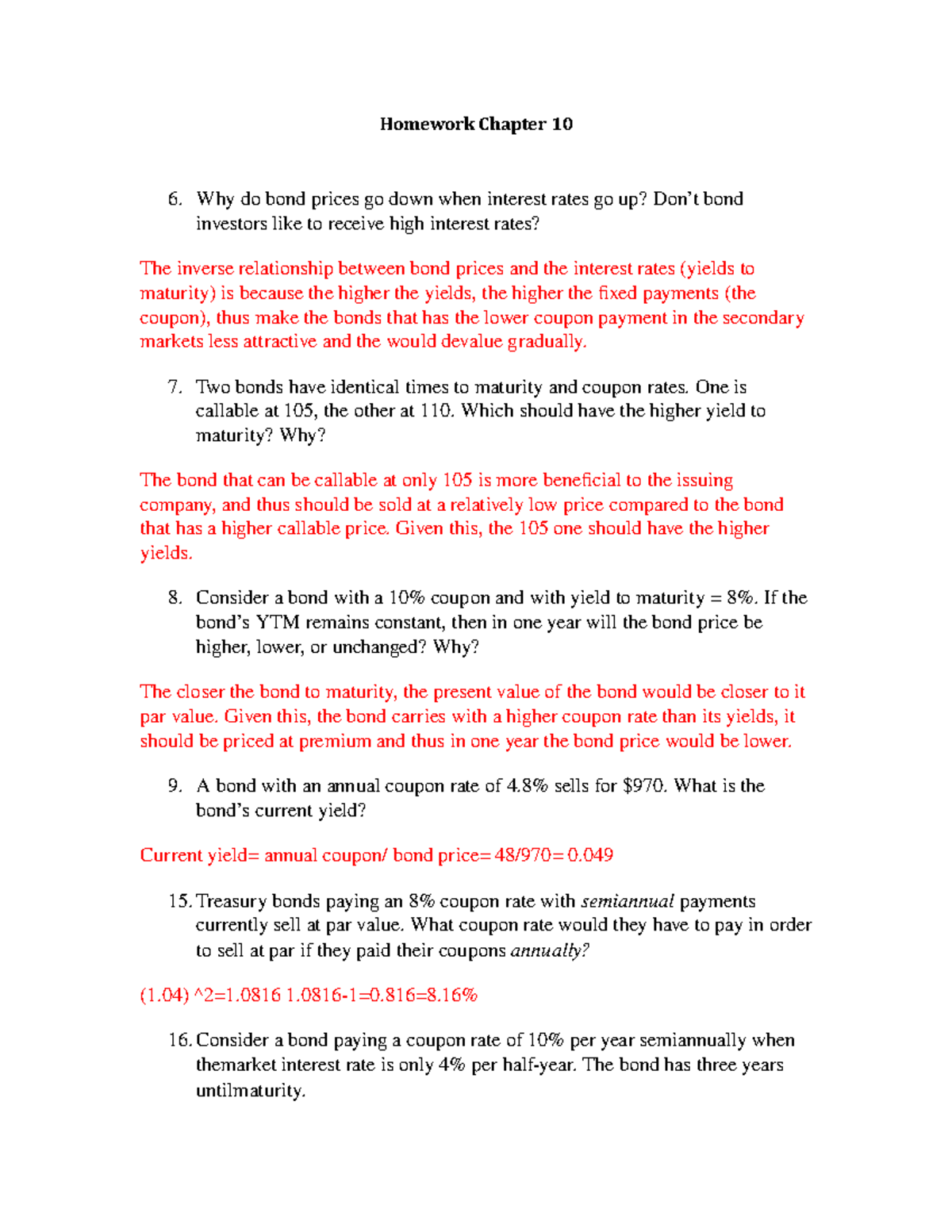

Micro 10-Year Yield Quotes - CME Group Vor 10 Stunden · Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures. 10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF 26.09.2022 · Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. A new 10-year TIPS will be auctioned Thursday. Anyone interested? One thing about Thursday's auction is certain: The Treasury will set the coupon rate for this TIPS at 0.125%, the lowest it will go for any TIPS. As of Friday's market close, the Treasury, on its Real Yields Curve page, was estimating that a full-term 10-year TIPS would have a real yield of -1.02%.

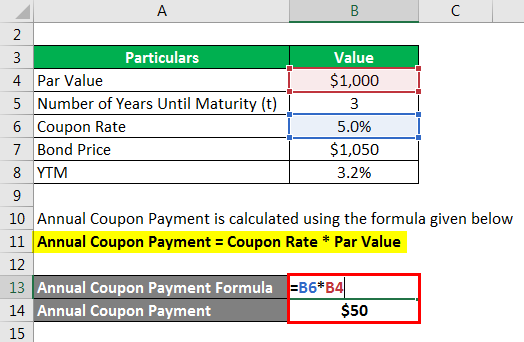

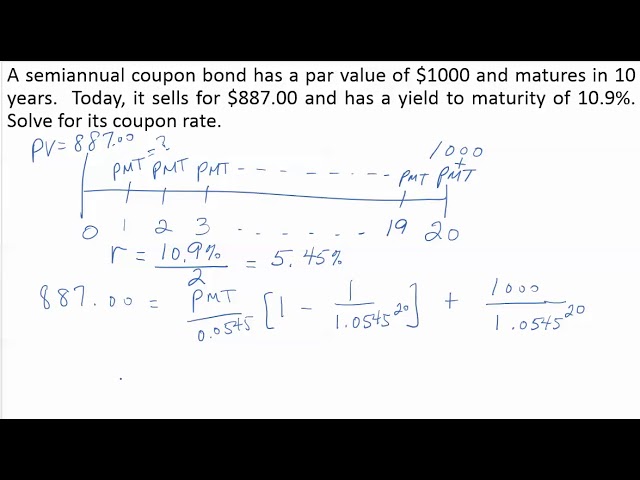

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Understanding Treasury Bond Interest Rates | Bankrate That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The semiannual coupon payments are half that, or $6.25 per $1,000. If you have a... Solved The 10-year Treasury Note has a coupon rate of 2.4% | Chegg.com A 10-year, BBB-rated corporate bond has a coupon of 4.3%. If the credit spread for BBB-rated bonds is 75 basis points, what is the price of the corporate bond? Assume coupons are paid semi- annually. Question: The 10-year Treasury Note has a coupon rate of 2.4% and is priced at 101.5% of par. A 10-year, BBB-rated corporate bond has a coupon of ... U.S. 10-Year Treasury Yield Rises to Levels Last Seen in 2010 ... The U.S. 10-year Treasury yield was approaching 4% in Tuesday trading, building off a recent surge that was sparked by elevated expectations for Federal Reserve interest-rate increases and ...

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

US 10 Year Treasury Yield - Investing.com Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive by holding the bond for 10 years.

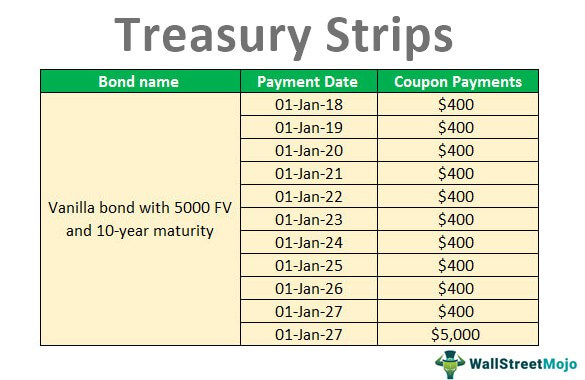

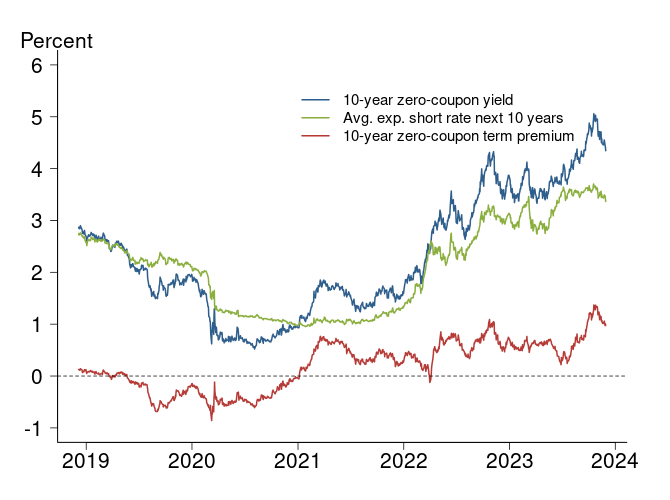

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Board of Governors of the Federal Reserve System (US), Fitted Yield on a 10 Year Zero Coupon Bond [THREEFY10], retrieved from FRED, Federal Reserve Bank of St. Louis; , September 13, 2022. RELEASE TABLES

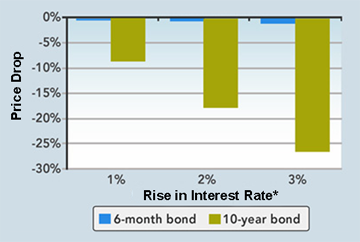

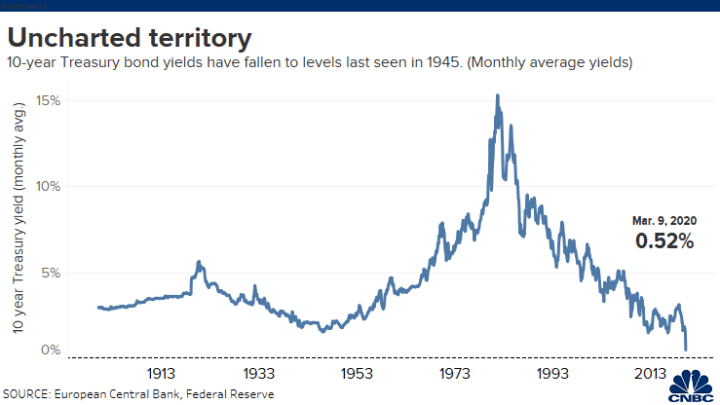

2-year Treasury tops 4.2%, a 15-year high as Fed jolts short-term rates ... Meanwhile, the yield on the 10-year hit an 11-year high of 3.829% earlier in the session but last traded two basis points lower at 3.685%. Yields and prices move in opposite directions, with one ...

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months.

10-Year T-Note Options Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

Ultra 10-Year U.S. Treasury Note Options Quotes - CME Group Ultra 10-Year Note Yield Curve Analytics ... a robust measure of 30-day implied volatility derived from deeply liquid options on Treasury futures. CME FedWatch. Explore probabilities for FOMC rate moves, compare target ranges or view historical rate data. Treasury Analytics. Analyze deliverable baskets, CTD/OTR securities, futures/cash yield ...

TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview Aggressive rally in U.S. government debt sends Treasury yields down by 10 to 15 basis points each, led by drop in 3-year rate; 10-year dips below 2.75% May. 24, 2022 at 10:09 a.m. ET by Vivien Lou ...

Treasury 10-Year Yields Rise Above 4% Amid Global Debt Selloff The benchmark US 10-year yield jumped as much as six basis points to 4% Wednesday, reaching that threshold for the first time since April 2010. It has now climbed almost 250 basis points in 2022 ...

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.715% Yield Day High 3.829% Yield Day Low 3.659% Yield Prev Close 3.708% Price 92.2969 Price Change +0.1719 Price Change % +0.1875% Price Prev Close 92.125 Price Day High 92.5156 Price...

Treasury makes full award of new 10-year bonds on strong demand 14.09.2022 · THE GOVERNMENT fully awarded the fresh Treasury bonds (T-bonds) it offered on Tuesday on strong demand for higher-yielding instruments amid expecta tions of more rate hikes in the United States.. The Bureau of the Treasury (BTr) raised P35 billion as planned via the fresh 10-year T-bonds it auctioned off on Tuesday, with total tenders reaching P99.311 billion or …

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of September 23, 2022 is 3.61%.

Government - Continued Treasury Zero Coupon Spot Rates* 3.06. 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot ...

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once...

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.69%, compared to 3.70% the previous market day and 1.41% last year.

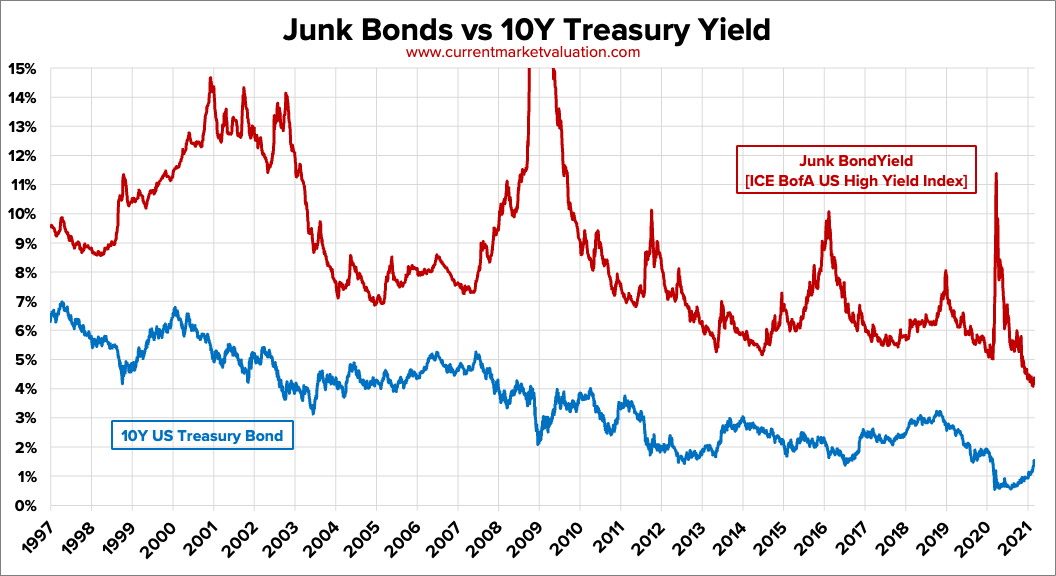

10-Year High Quality Market (HQM) Corporate Bond Spot Rate 10.09.2022 · Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Aug 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA.

10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing August 8th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today.

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 16, 2022 is 3.45%. Show Recessions Download Historical Data Export Image

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview 21.09.2022 · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

Understanding The 10-Year Treasury Yield - Forbes Advisor The 10-year Treasury yield also impacts the rate at which companies can borrow money. When the 10-year yield is high, companies will face more expensive borrowing costs that may reduce their ...

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

/shutterstock_164681615-5bfc3a9246e0fb00517ff39b.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

:max_bytes(150000):strip_icc()/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

Post a Comment for "45 coupon rate 10 year treasury"